Comprehensive AUD/USD for November 7, 2023

In this comprehensive analysis, Ultima Markets brings you an insightful breakdown of the AUD/USD for 7th November 2023.

Key Takeaways

- Changes in the RBA’s monetary policy: The Reserve Bank of Australia will announce its latest interest rate decision at noon. Due to the unexpectedly strong CPI in Australia in the third quarter and the rebound in housing prices to near record highs, the market expects that the possibility of the Reserve Bank of Australia raising interest rates by 25 basis points this week reaches 60% %. On the contrary, if there is no sign of tightening in monetary policy, AUD/USD will enter a rapid downward trend.

- Bullock has a hawkish attitude: The new chairman of the Reserve Bank of Australia, Bullock, said in a public speech that “if the inflation outlook shows a substantial increase, we will not hesitate to further raise the cash rate.” Expectations that the Reserve Bank of Australia will resume raising interest rates have triggered a strong rise in the Australian dollar recently.

AUD/USD Technical Analysis

AUD/USD Daily Chart Insights

- Stochastic Oscillator: The indicator has entered the overbought area, indicating the strength of the current bullish trend. Although there were signs of a reversal yesterday, we cannot judge that a reversal is coming without confirmation.

- Moving average: After the exchange rate strongly breaks through the 33-day moving average and the 65-day moving average, it hints that the current bullish trend is coming, and the resistance level is looking towards the 200-day moving average (dashed line). There is a certain probability of going back to the green 5-day moving average.

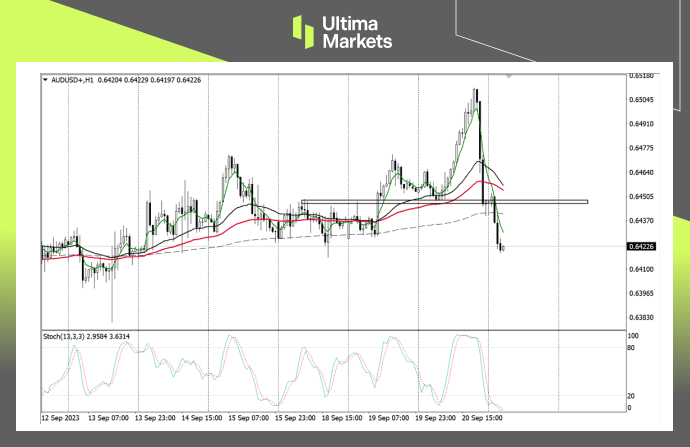

AUD / USD 1-hour Chart Analysis

- Stochastic oscillator: The indicator is still in the oversold area. Judging from the market trend, it is currently in the consolidation stage. Wait for the indicator to show a long signal before paying attention to whether there are trading opportunities.

- Price Action: After consolidation for two trading days, the market formed a rectangular range. After falling below the range, the exchange rate will most likely continue to decline in the short term. Pay attention to the support price below.

- Support price: The red 65-period moving average is the first target support level. If the market enters a deep correction, continue to look at the upper edge of the upward channel line.

Ultima Markets MT4 Pivot Indicator

- According to the pivot indicator in Ultima Markets MT4, the central price of the day is established at 0.64993,

- Bullish Scenario: Bullish sentiment prevails above 0.64993, first target 0.65131, second target 0.65371;

- Bearish Outlook: In a bearish scenario below 0.64993, first target 0.64752, second target 0.64608.