BYD Overtakes Ford in August Car Sales: What Does It Mean for the Auto Industry?

According to TrendForce report, car sales in 37 markets around the world totaled 5.55 million units in August 2023, an increase of nearly 1% from July. The growth momentum came from the launch of new models for the autumn.

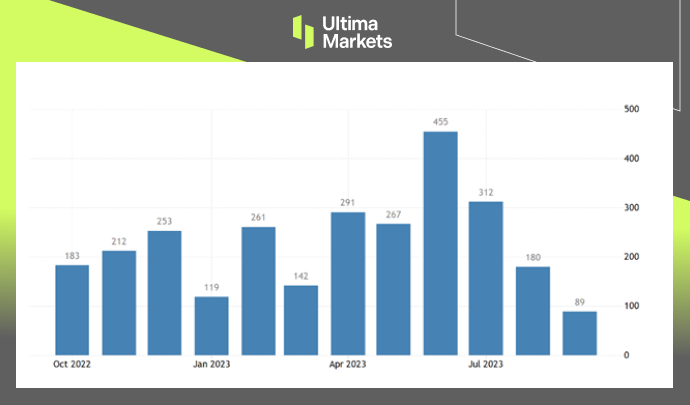

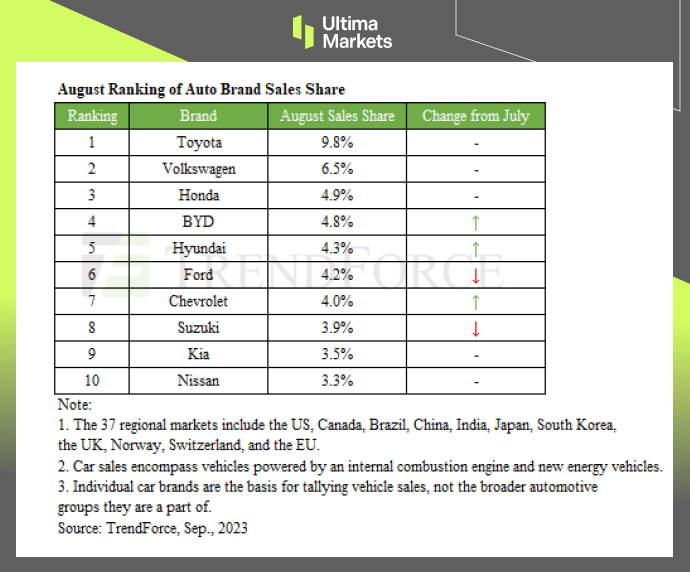

(August Ranking of Auto Brand Sales Share)

The composition of the top ten brands is the same as last month. The top three are Toyota, Volkswagen, and Honda. The Chinese car manufacturer BYD replaced Ford and became the fourth-largest brand in August car sales.

BYD’s Remarkable Growth

BYD has converted all its models to new energy vehicles, so the lukewarm domestic demand in the Chinese market has less impact on it. BYD recorded a MOM growth of 5%, and the market share was only 0.1% behind the third-placed Honda.

However, Japanese car manufacturers also have contributions from markets such as Southeast Asia. Consequently, for BYD to surpass Honda in the global market, the key is its expansion speed in overseas markets.

Ford’s Decline in August Sales

Ford’s ranking fell to sixth place due to lower sales in Europe and the United States compared with the previous month, with sales declining by 6.7% month-on-month.

Challenges and Variables in 2H23

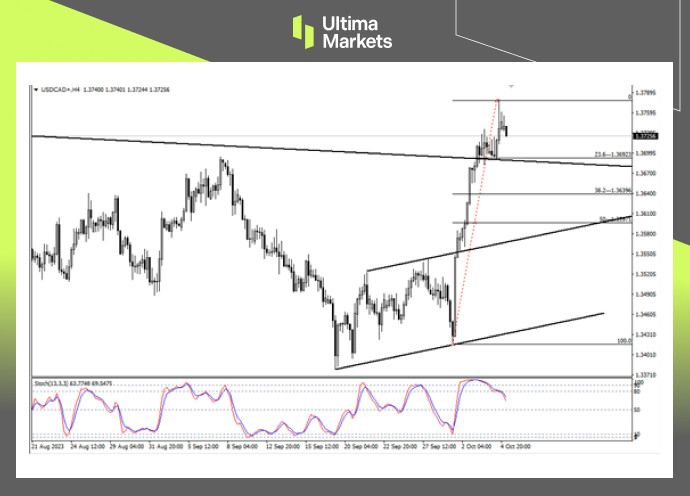

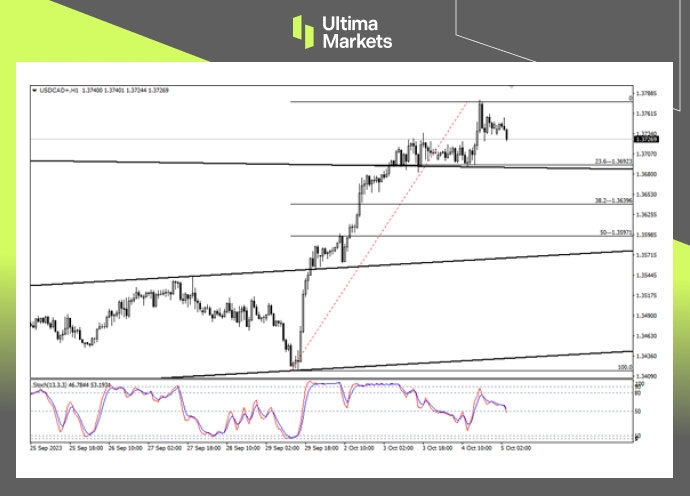

Although the launch of autumn models will help new car sales, there are still many variables in 2H23, including the United Auto Workers (UAW) strike that has not yet ended; OPEC+ allies’ crude oil production cuts, etc.

Strategies for the Fourth Quarter

As the fourth quarter approaches, auto manufacturers will do their best to ensure smooth production, fulfill orders, and stimulate year-end sales, minimizing the impact of reduced order visibility caused by economic changes.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.