Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

美联储在放缓降息中面临平衡难题

平衡通胀与就业

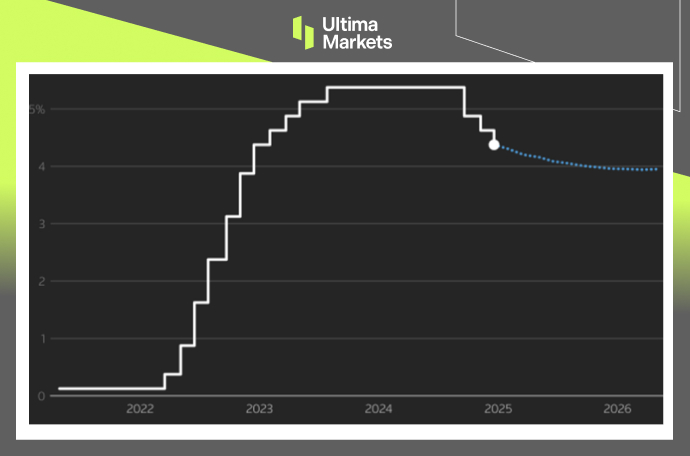

上周日,美联储理事阿德里亚娜·库格勒和旧金山联储主席玛丽·戴利强调了美国央行今年在放缓降息步伐时面临的复杂平衡难题。去年,美联储将短期利率下调了整整一个百分点,降至当前的4.25%-4.50%区间。

(市场预期的美国联邦基金利率图表,来源:统计局)

“我们完全清楚,目前还没有达到目标,所以现在还没庆祝什么任何东西” 库格勒在旧金山举行的美国经济学会年会上表示。去年11月,失业率为4.2%,库格勒和戴利都认为这一水平符合美联储的双重目标:最大就业和价格稳定。戴利补充道: “在当前阶段,我不希望劳动力市场出现进一步疲软,也许某些月份会有自然的波动,但肯定不能出现额外的放缓。” 她在同一场小组讨论中发表了这些言论。

根据美联储首选的通胀指标,通胀已从2022年年中约7%的峰值大幅下降至去年11月的2.4%。尽管如此,这一水平仍高于美联储2%的目标。去年12月,决策者调整了他们的预测,预计实现这一目标的进展将比此前预期更为缓慢。

此外,美国上周新增失业救济申请人数降至八个月来的最低水平,表明2024年底裁员情况较少,劳动力市场依然强劲。加州和德州的未调整申请人数大幅下降,而密歇根州、新泽西州、宾夕法尼亚州、俄亥俄州、马萨诸塞州和康涅狄格州的申请人数则出现显著增加。

免责声明

本文所含评论、新闻、研究、分析、价格及其他资料仅供参考,旨在帮助读者了解市场形势,并不构成投资建议。Ultima Markets已采取合理措施确保资料的准确性,但不能保证资料的绝对准确性,并可能随时更改,恕不另行通知。Ultima Markets对于因直接或间接使用或依赖此类资料而可能导致的任何损失或亏损(包括但不限于利润损失)不承担责任。

随时随地观察市场动态

市场易受供求关系变化的影响

对关注价格波动的投资者极具吸引力

流动性兼顾深度与多元化,无隐藏费用

无对赌模式,不重新报价

通过 Equinix NY4 服务器实现指令快速执行