Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom配股怎么算?一文看懂现金增资与除权价计算,做出有利决策

当公司宣布现金增资(俗称“配股”)时,许多投资者心中立刻浮现疑问:“配股怎么算?”因为这项决策直接影响股价波动与您的资产价值,所以理解其计算原理至关重要。

本文将用2025年最新市场案例,一步步解析除权参考价的计算公式,并提供实用的参与决策指南,帮助您在复杂的市场变化中掌握先机。

在计算配股之前,交易者必须了解哪些现金增资的关键名词?

配股怎么算的第一步,是理解现金增资的本质。这并非公司免费送股,而是为筹集资金(如扩厂或研发),让现有股东以优惠价认购新股。

根据台湾证券交易所2025年数据,超过60%的上市柜公司曾办理现金增资,显示其常见性。

- 认购价:股东购买新股的折扣价,通常低于市价。

- 配股率:例如每持有1000股旧股,可认购100股新股,比例为0.1。

- 除权交易日:此日后买股者无法参与增资,股价开始调整。

配股怎么算?除权参考价公式详解

除权参考价是公司在除权交易日当天的开盘竞价基准。

由于总股数增加,理论上每股价格会向下调整,以反映股权稀释的影响。了解如何计算,有助于预测股价的可能变动。

除权参考价 = (除权前一日收盘价 + (认购价 × 配股率)) / (1 + 配股率)

实例演练

假设A公司除权前收盘价为100元,现金增资认购价70元,配股率为每千股认100股(即0.1)。

带入公式计算:(100 + (70 × 0.1)) / (1 + 0.1) = 107 / 1.1 ≈ 97.27元。因此,除权交易日当天的参考价即为97.27元。

交易者如何判断是否参与增资?

交易者不仅要懂得配股怎么算,更要评估参与现金增资的效益。因为短期股价调整难免,所以长期价值取决于公司基本面。

以下表格比较决策要点:

| 情境 | 优点 | 缺点 |

| 参与 | 认购价差具吸引力,看好公司成长 | 需投入现金,若市场贴权可能亏损 |

| 不参与 | 节省资金,避免稀释风险 | 股权占比下降,错失潜在收益 |

结语

总结来说,了解“配股怎么算”的核心在于掌握除权参考价的计算方式,并意识到这项财务工具本身是中性的。

投资者应回归基本面,评估公司筹资的用途与未来发展潜力,而非仅被短期的股价变动所影响,才能做出最有利的决策。

FAQ

Q:如果不参与配股,我的股票会怎么样?

A:您的持股数量不变,但由于公司总股本增加,您的股权占比会被稀释。此外,除权后股价会下修,您的股票市值短期内会减少。

Q:参与配股一定赚钱吗?

A:不一定。虽然认购价通常低于市价,但如果除权后市场不看好,股价可能跌破除权参考价甚至认购价,这种情况称为“贴权”,参与者仍可能亏损。

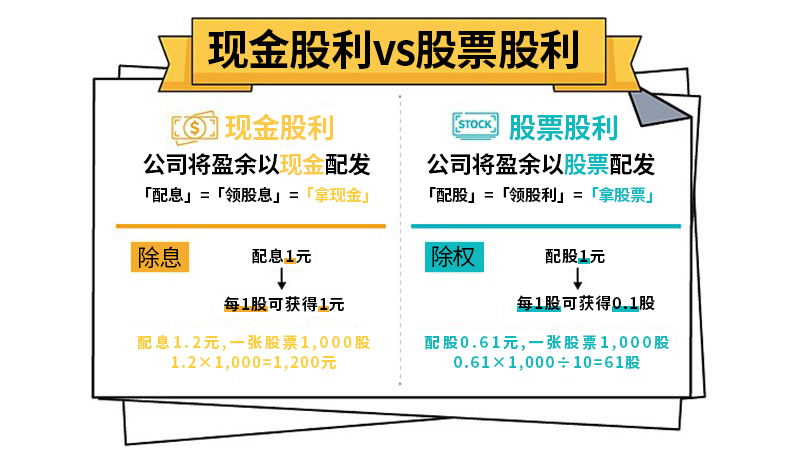

Q:配股跟配息有什麼不同?

A:“配股”是公司发行新股让股东用钱认购(现金增资);“配息”则是公司将获利以现金形式发放给股东(现金股利),两者资金来源与对股东的影响完全不同。

。免责声明:本内容仅作为参考信息,不能视为任何形式的金融、投资或专业建议。文中观点不代表 Ultima Markets 或作者对任何特定投资产品、策略或交易的推荐。请勿仅依据本资料作出投资决策,必要时请咨询独立专业顾问。