Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: UK clients are kindly invited to visit https://www.ultima-markets.co.uk/. Ultima Markets UK expects to begin onboarding UK clients in accordance with FCA regulatory requirements in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Ultima Markets App

Trade Anytime, Anywhere

Persistent Inflation Pressures Fed to Stay Resolute on Rates

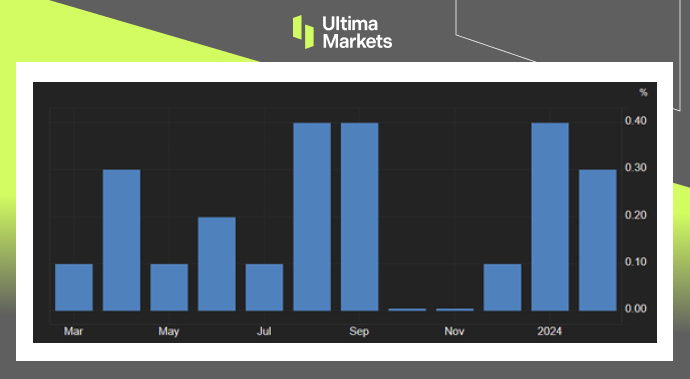

The U.S. personal consumption expenditure price index (PCE) increased 0.3% month-over-month in February 2024. The increase was lower than the upwardly revised 0.4% rise in January and lower than the forecasted 0.4%. Prices for services went up 0.3%, while prices for goods rose 0.5%. The annual rate edged up to 2.5%, in line with forecasts, from 2.4%, which was the lowest since February 2021.

Meanwhile, the monthly core PCE inflation, which excludes food and energy and is the preferred inflation measure by the Federal Reserve, slowed to 0.3% from an upwardly revised 0.5% in January, matching expectations.

Separately, food prices increased 0.1%, and energy prices soared 2.3%. Finally, the annual core inflation rate slowed to 2.8%, the lowest in about three years, from 2.9%.

(PCE Price Index MoM%,U.S. Bureau of Economic Analysis)

In remarks made at the San Francisco Fed, Chair Powell indicated that the PCE inflation data from February aligned more closely with the Federal Reserve’s expectations, which is a positive development. The recent figures may not measure up to the more favorable data seen last year, yet this does not compel the Fed to rush into reducing interest rates. Patience is key, as policymakers can observe greater certainty before considering rate cuts. Chair Powell elaborated that while the Fed anticipates a decrease in inflation as part of their primary scenario, should this not transpire, the willingness to maintain current rates for an extended period is on the table.

As investors pored over a set of economic data during a low-volume Good Friday trading session, the dollar index retreated, slipping below 104.5 on Friday after previously reaching a six-week peak of 104.7.

(Dollar Index Weekly Chart)

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

لماذا تختار تداول المعادن والسلع مع Ultima Markets؟

توفر Ultima Markets البيئة التنافسية الأفضل من حيث التكلفة والتبادل للسلع السائدة في جميع أنحاء العالم.

ابدأ التداولمراقبة فعالة للسوق أثناء تنقلك

الأسواق عرضة للتغيرات في العرض والطلب

جذابة للمستثمرين المهتمين فقط بالمضاربة على الأسعار

سيولة عميقة ومتنوعة بدون رسوم مخفية

لا يوجد مكتب تداول ولا إعادة تسعير

تنفيذ سريع عبر خادم Equinix NY4