Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: UK clients are kindly invited to visit https://www.ultima-markets.co.uk/. Ultima Markets UK expects to begin onboarding UK clients in accordance with FCA regulatory requirements in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Ultima Markets App

Trade Anytime, Anywhere

Oil Markets Surge Amidst Geopolitical Uncertainty

Geopolitical Turmoil Fuels Oil Price Surge

Amidst the volatile landscape of the global oil market, October 2023 stands out as a month of upheaval and uncertainty, with crude oil prices surging to a noteworthy $90 per barrel.

This escalation can be attributed to escalating geopolitical tensions, notably the intensifying conflicts between Israel and Gaza, which has far-reaching implications for the world’s energy sector.

Crude Prices Rushed to US$90 on Escalating Tensions in Middle East

Escalating turmoil between Israel and Gaza ramped up concerns of supply disruptions among key producers in the Middle East. Additionally, U.S. military forces in Iraq were targeted in two separate drone attacks further intensifying market sentiment. Both WIT and Brent have emerged at the $90 per barrel mark, a significant technical threshold.

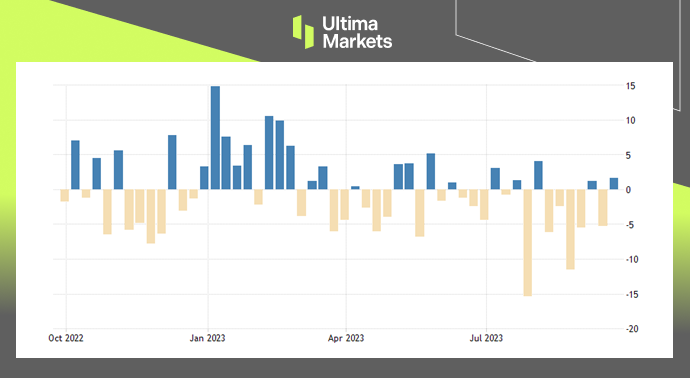

(Brent Crude One-year Chart)

(WIT Crude One-year Chart)

Sharp Decrease in Global Oil Reserves

According to the latest International Energy Agency (IEA) report, in August, there was a significant decline in global oil inventories, with a decrease of 63.9 million barrels (mb) observed.

This drop was primarily driven by a massive drawdown of 102.3 mb in crude oil stocks. Initial data indicates that inventories on land continued to decrease in September, but there was a rebound in oil stored on water as exports started to recover.

Inventory Trends

In the OECD countries, industry stocks experienced an unusual decline of 6.5 mb in August, reaching a total of 2,816 mb, which is substantially lower by 105.3 mb compared to the five-year average.

Conclusion

In conclusion, the surge in crude oil prices to $90 per barrel in October 2023 can be primarily attributed to escalating geopolitical uncertainty, particularly in the Middle East.

The tensions between Israel and Gaza, coupled with drone attacks on U.S. military forces in Iraq, have heightened concerns about potential disruptions in the global oil supply chain.

As a result, the energy industry and financial markets are navigating a period of uncertainty, emphasizing the interconnectedness of geopolitics and global energy markets.

We will continue to watch these developments closely, as they have the potential to reshape the oil market landscape in the coming months.

لماذا تختار تداول المعادن والسلع مع Ultima Markets؟

توفر Ultima Markets البيئة التنافسية الأفضل من حيث التكلفة والتبادل للسلع السائدة في جميع أنحاء العالم.

ابدأ التداولمراقبة فعالة للسوق أثناء تنقلك

الأسواق عرضة للتغيرات في العرض والطلب

جذابة للمستثمرين المهتمين فقط بالمضاربة على الأسعار

سيولة عميقة ومتنوعة بدون رسوم مخفية

لا يوجد مكتب تداول ولا إعادة تسعير

تنفيذ سريع عبر خادم Equinix NY4