Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United Kingdom

Record High DAX Index, Improved Economic Data and Rate Cuts

Germany Composite PMI: A Positive Turn Amidst Contraction

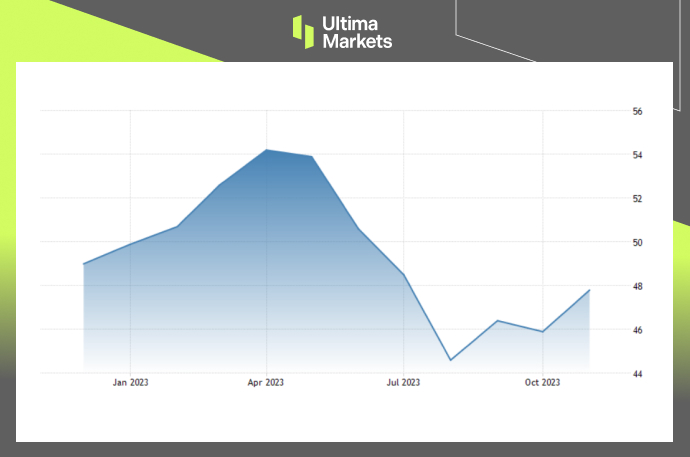

The HCOB Germany Composite PMI for November 2023 surpassed initial estimates, reaching 47.8, up from the preliminary 47.1 and the October reading of 45.9.

While the index indicates an ongoing contraction, it’s noteworthy that the pace of decline was the slowest in four months. Notably, signs of stabilization surfaced, particularly in the services sector. Manufacturing production also witnessed the smallest drop since May.

Despite the overall contraction, total new business and foreign new work experienced their least severe declines in five and seven months, respectively. This positive trend occurred despite a slight decline in employment.

On the pricing front, output charge inflation remained steady at October’s 32-month low, while input cost inflation accelerated. Business expectations, while improving for the second consecutive month, continue to remain cautiously optimistic.

(Germany Composite PMI,HCOB)

DAX Rally Propelled by ECB Dovish Notes

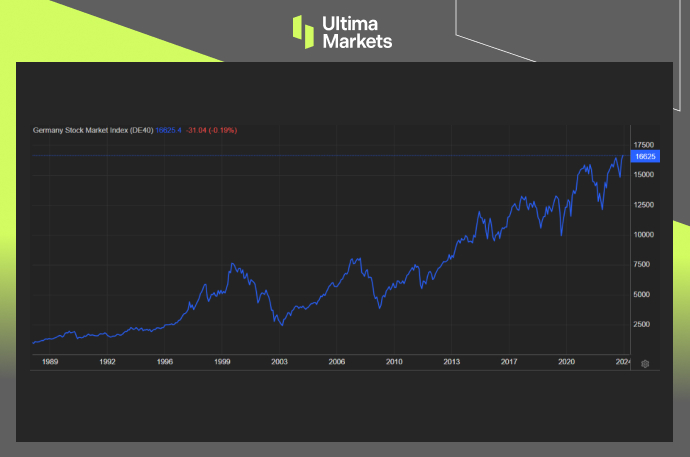

The DAX index witnessed a remarkable surge following a dovish shift in the European Central Bank’s (ECB) tone, particularly articulated by influential ECB board member Isabel Schnabel. Schnabel’s comments, suggesting a significant fall in inflation, signal a departure from previous inclinations toward interest rate hikes.

This shift in perspective has elevated expectations of a rate cut, with investors anticipating a reversal of the steepest increase in interest rates in the ECB’s quarter-century history.

Isabel Schnabel, a key figure in the conservative camp of policymakers, emphasized that policymakers should not commit to steady rates through mid-2024. This stance contrasts with her earlier support for rate hikes as a measure to counter high inflation.

The DAX responded positively to this shift, reaching an all-time peak of 16,656 before settling 0.75% higher. The November US private payrolls, falling below forecasts, further fueled hopes of central banks trimming rates ahead of schedule.

(DAX Index Historical Performance)

Frequently Asked Questions

Q1: What is the significance of the HCOB Germany Composite PMI?

A1: The HCOB Germany Composite PMI serves as a crucial economic indicator, reflecting the overall health of Germany’s private sector. Despite a reading below 50 indicating contraction, specific details within the index reveal nuances such as the pace of decline, stabilization signs, and sector-specific performance.

Q2: How did Isabel Schnabel’s comments impact the DAX index?

A2: Isabel Schnabel’s dovish remarks, signaling a notable decrease in inflation and a shift away from potential rate hikes, propelled the DAX index to record highs. The market responded positively, with investors anticipating a reversal of recent interest rate increases.

Bottom Line

Explore more about the DAX index, PMI data, Germany manufacturing, and other related topics in this comprehensive article tailored for those seeking in-depth insights into the current economic landscape.

لماذا تختار تداول المعادن والسلع مع Ultima Markets؟

توفر Ultima Markets البيئة التنافسية الأفضل من حيث التكلفة والتبادل للسلع السائدة في جميع أنحاء العالم.

ابدأ التداولمراقبة فعالة للسوق أثناء تنقلك

الأسواق عرضة للتغيرات في العرض والطلب

جذابة للمستثمرين المهتمين فقط بالمضاربة على الأسعار

سيولة عميقة ومتنوعة بدون رسوم مخفية

لا يوجد مكتب تداول ولا إعادة تسعير

تنفيذ سريع عبر خادم Equinix NY4