Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomThe Swiss Franc to USD Forecast for December 2025 focuses on one of the most actively watched FX pairs in a month loaded with central bank decisions. With the Federal Reserve and Swiss National Bank (SNB) holding back-to-back meetings, USD/CHF volatility is expected to increase sharply.

At the time of writing, USD/CHF trades around 0.804–0.806, with traders pricing in a potential December Fed rate cut while the SNB is expected to maintain policy stability. These factors create a tight but reactive environment for USD/CHF, making this one of the most important weeks for CHF traders this year.

Swiss Franc to USD Forecast, Key Market Drivers

Federal Reserve Expectations (USD Side)

The main reason traders expect pressure on the USD right now is the upcoming Federal Reserve meeting on December 9–10. Markets have been increasingly confident that the Fed will deliver a 25bps rate cut, which directly impacts the value of the US dollar. When the Fed cuts interest rates, the yield on US assets becomes less attractive, meaning global investors earn less by holding USD-denominated bonds and deposits. As a result, demand for the dollar weakens, and this usually pulls USD/CHF downward.

What really matters, however, is not just the rate cut itself, but how the Fed communicates the decision. If the Fed cuts rates and also signals that more cuts are likely in 2026, or expresses concern about slowing inflation too aggressively, then the market interprets this as dovish. A dovish Fed typically leads to additional USD weakness, making it more likely that USD/CHF will fall.

On the other hand, the Fed may choose to cut rates but warn that inflation remains stubborn or that the US economy still requires a firm policy stance. This combination lowering rates but using strong inflation language is often called a “hawkish cut.” In this scenario, USD/CHF may initially fall on the headline, but can rebound quickly because traders reassess and realise that the Fed might slow down future cuts. That kind of reaction supports USD strength and may push USD/CHF upward, at least temporarily.

- If the Fed is clearly dovish, USD/CHF likely moves down.

- If the Fed is hawkish or cautious, USD/CHF may attempt to move up or stay supported.

Swiss National Bank (CHF Side)

Right after the Fed meeting, traders immediately shift their attention to the Swiss National Bank meeting on December 11, which makes this one of the most sensitive weeks for USD/CHF in the entire year.

The SNB has been consistent in stating that it wants to maintain policy stability, and it has shown no interest in returning to negative interest rates, even though Swiss inflation continues to stay very low. This steady approach makes the Swiss Franc structurally strong, because investors view Switzerland as a safe and stable economic environment especially when global uncertainty rises.

If the SNB simply keeps policy unchanged while the Fed cuts, the interest rate gap between the USD and CHF narrows. When the gap becomes smaller, investors have less incentive to hold USD, and the market naturally pushes USD/CHF lower.

However, the SNB can still surprise the market. If the bank expresses worries about overly low inflation or unexpected weakness in the Swiss economy, it may hint at future easing or intervention. Even a subtle comment like “the bank remains ready to act in the FX market if needed” can make traders anticipate a weaker CHF. In that case, USD/CHF may move upward as the CHF loses some of its safe-haven appeal.

Another crucial factor is Switzerland’s role as a safe-haven market. During global risk-off situations, geopolitical stress, weak stock markets, or recession fears. Money tends to flow into CHF regardless of interest rates. That alone can pull USD/CHF downward without any central bank action.

- If the SNB stays firm and stable while the Fed cuts, USD/CHF likely drifts lower.

- If the SNB shows concern about inflation and hints at easing → USD/CHF may rise.

When combining both central banks:

- Most likely short-term direction: mild downward pressure on USD/CHF, because the Fed is more dovish than the SNB.

- Most likely reversal trigger: the SNB turning unexpectedly soft, or the Fed delivering a hawkish message.

- Wild card: global risk sentiment, any increase in fear strengthens CHF and sends USD/CHF lower.

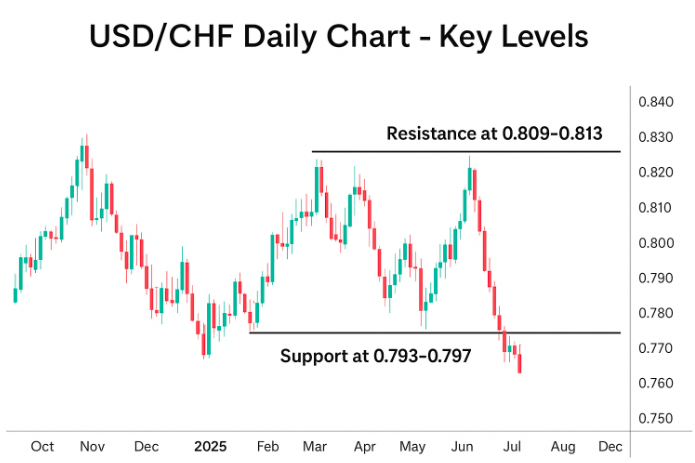

USD/CHF Technical Analysis

Overall Trend

USD/CHF has been trading within a tight range, waiting for central bank catalysts. The pair remains below key resistance, indicating the market is cautious ahead of the Fed/SNB decisions.

Key Resistance Levels (Upside)

- 0.809–0.813 – heavy resistance zone tested multiple times

- 0.820 – psychological resistance if breakout occurs

- 0.833 – next upside target for bulls

A daily close above 0.813 opens the door for the bullish breakout scenario.

Key Support Levels (Downside)

- 0.797–0.793 – major weekly support

- 0.792 – critical breakdown level

- 0.780 – bearish extension target

A sustained break below 0.792 could trigger a larger CHF rally.

What Will Move USD/CHF Next?

Federal Reserve Meeting (Dec 9–10, 2025)

- Expected volatility: High

- What matters: Rate decision, Forward guidance, Press conference tone

SNB Policy Meeting (Dec 11, 2025)

- Expected volatility: High

- What matters: SNB inflation projections, Interest rate stance, FX intervention comments

Key US Data Releases

- US PCE (inflation)

- Non-farm payrolls

- ISM services PMI

Any upbeat US data could give USD temporary support.

Trading Scenarios for USD/CHF (Practical Setups)

Scenario 1: Fed Cut → USD Weakness → CHF Strength

If the Federal Reserve delivers a fully dovish rate cut, one that signals confidence inflation is cooling and hints at more easing in early 2025. USD/CHF is likely to continue drifting lower as the dollar loses yield support. In this scenario, traders often look for price to break below the 0.797 area and extend toward the deeper support zone around 0.793, which acts as a key line separating short-term bearish continuation from a larger trend shift.

Scenario 2: Hawkish Fed → Temporary USD Bounce

However, if the Fed surprises with a “hawkish cut,” meaning they lower rates but stress ongoing inflation risks or push back against aggressive easing expectations, the dollar could rebound temporarily. In this case, USD/CHF may retest the resistance region between 0.809 and 0.813, an area where sellers have historically stepped in. Meanwhile, the SNB’s stance remains crucial.

Scenario 3: SNB Shock (Less Likely but High Impact)

If the SNB maintains its firm, steady policy while the Fed signals more cuts ahead, the larger trend still favors CHF strength. But any unexpected SNB concern about inflation or hints that the bank might allow the currency to weaken, could create a sharp reversal, pushing USD/CHF higher even if the Fed turns dovish. In short, the direction of USD/CHF depends on how each central bank’s message influences relative yield expectations and safe-haven flows, with traders focusing on whether price breaks below key support or gets rejected by overhead resistance.

Is Now a Good Time to Trade USD/CHF?

Yes, December is historically high-volatility for USD/CHF due to central bank decisions and end-of-year flows. Traders should prepare for whipsaws and manage risk carefully.

Conclusion

The USD/CHF pair is poised for major movement as December’s Fed and SNB meetings approach. Traders should closely monitor support at 0.793–0.797 and resistance at 0.809–0.813, as either side may break depending on central bank messaging.

If you plan to trade USD/CHF, platforms like Ultima Markets offer multi-asset access, tight spreads, MT4/MT5 availability, and tools suitable for forex traders. However, traders should always verify regulation, account protection, and suitability before depositing funds.

For now, the Swiss Franc to USD Forecast leans toward range trading, with a breakout likely once central bank clarity emerges. Prepare your chart levels, review risk, and watch the calendar, this is one of the most important trading weeks of the year for USD/CHF.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.