Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomHow Negative Balance Protection Can Help

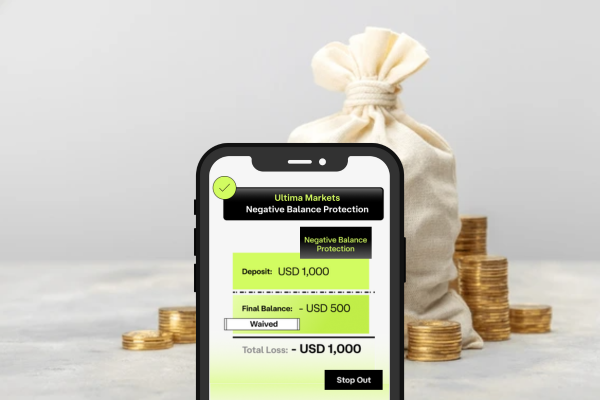

Negative balance protection is one of the key safeguards for anyone trading forex and CFDs with leverage. It caps your maximum loss at the amount you deposit so a single extreme move does not turn into a debt problem.

This article explains what negative balance protection is, how it works in practice, how regulators view it, and how Ultima Markets applies it on its platform.

What Is Negative Balance Protection

Negative balance protection is a broker policy that prevents your trading account from going below zero.

Without it, a sharp price move or gap can push your losses beyond your remaining equity and leave your account negative. In that case you would technically owe money to the broker.

With negative balance protection, if an extreme move pushes your account below zero, the broker absorbs the shortfall and resets your balance back to zero. You can still lose all the money you deposited in that account, but not more.

Why Negative Balance Protection Matters

Negative balance protection matters for three simple reasons:

- It limits extreme events such as gaps and flash moves that can bypass stop losses

- It provides clarity on your maximum financial exposure so you know you cannot end up owing money

- It aligns with modern regulatory standards for retail CFD trading in regions like the EU and UK

It is not a promise of profit, but it does cap the worst case when markets move faster than your risk controls.

How Does the Negative Balance Protection Work

To see how it fits into day to day trading, you need to understand how a leveraged account is managed.

- You deposit funds which become your account balance

- You use a portion of that balance as margin to open leveraged positions

- As prices move, your open profit and loss changes and your equity rises or falls

Most brokers define two levels:

- Margin call level

When your equity falls to this level you receive a warning to reduce risk or add funds - Stop out level

When your equity falls further, the broker starts closing positions automatically to protect your account

In normal conditions these controls protect you before the balance hits zero. In very fast or illiquid markets, however, orders may be filled at worse prices than expected. If the loss ends up larger than your remaining equity, the account would go negative.

With negative balance protection in place

- the system detects the negative balance

- the account is reset back to zero

- you are not asked to repay the shortfall

You lose the deposited funds in that account but do not incur additional debt.

Regulatory View In Brief

Regulators in regions such as the European Union and the United Kingdom require brokers to provide negative balance protection for retail clients trading CFDs, alongside:

- leverage limits

- margin close out rules on a per account basis

- standardised risk warnings

These measures are designed to ensure that a retail trader’s maximum loss is limited to the money they place in their CFD account.

Professional clients are often treated differently. They may have access to higher leverage but may not automatically receive negative balance protection, depending on the broker and jurisdiction.

Negative Balance Protection At Ultima Markets

Ultima Markets applies negative balance protection as part of its client protection framework.

On the Ultima Markets platform:

- your account is protected from losing more than the funds you deposit under normal trading conditions

- if high volatility or a sharp gap causes your account to slip below zero, the system automatically detects this and resets the negative balance to zero

- negative balance protection is provided to clients at no additional cost, subject to risk assessment and terms and conditions

Ultima Markets also encourages traders to reduce the chance of negative balances by:

- managing trade volume

- using stop loss orders

- controlling leverage and avoiding excessive exposure

Taken together, these tools and protections support a smoother and more controlled trading experience. You should always review the latest terms on the Ultima Markets website to understand how negative balance protection applies to your specific account and region.

Key Benefits And Limitations

You can think of negative balance protection in terms of what it clearly gives you and what it cannot do.

| Aspect | What It Offers | What It Cannot Do |

| Maximum Loss | Caps loss at your deposited funds in that trading account | Cannot prevent you from losing your entire deposit |

| Extreme Events | Helps protect against gaps, flash moves and fast slippage | Cannot remove normal day to day market risk |

| Transparency | Makes your maximum liability clear in advance | Cannot replace careful reading of terms and conditions |

| Client Classification | Often standard for regulated retail CFD accounts | May not apply to professional or offshore accounts |

| Trader Behaviour | Supports confidence in using leverage responsibly | Can encourage over leverage if misunderstood or abused |

Using Negative Balance Protection Wisely

Negative balance protection works best when it is one part of a wider risk plan rather than the core of your strategy.

Practical guidelines

- Treat it as a backup

Build your plan around position sizing, risk per trade and clear exit rules. Assume negative balance protection is there only for rare extremes. - Use conservative leverage

Even with protection, very high leverage can wipe out your account quickly. Keep leverage at levels that fit your strategy and risk tolerance. - Stay aware of volatility

Check economic calendars and major news. Be cautious around central bank decisions, key data releases and major political events. - Know your status

If you change broker or move from retail to professional classification, confirm whether negative balance protection still applies and on what terms.

Final Thoughts

Negative balance protection is a simple idea with powerful implications. It prevents your trading account from going below zero and caps your maximum loss at the money you deposit.

On a platform such as Ultima Markets, negative balance protection sits alongside margin controls, stop outs, stop losses and leverage management. Together, they form a more complete risk framework.

It will not make a bad strategy profitable, but combined with disciplined trading and sensible leverage, negative balance protection can help you approach the markets with clearer boundaries and greater confidence in your downside risk.

Disclaimer: This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.