Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomCentral Bank Super Week: Divergence to Drive Markets

Daily Market Insights – December 8, 2025, Brought to you by Ultima Markets.

The market has entered a critical holding pattern, known as the “Blackout Period,” during which Fed officials are prohibited from making public comments. Following last week’s pivotal PCE release, the focus has shifted from whether the Fed will cut rates to how it will communicate the decision in its latest policy decision this week.

PCE Data Confirms Stability, Bolsters December Cut

The delayed September PCE Price Index (released Friday) confirmed a stable inflation environment, removing the primary obstacle to the Federal Reserve’s planned policy easing:

- Core PCE YoY: 2.8% (Previous: 2.9%)

- Headline PCE YoY: 2.8% (Previous: 2.7%)

The data indicate that inflation remains stable and below the critical 2.9% threshold. This outcome aligns closely with market expectations, validating the Fed’s dovish pivot. The market interprets this as the final piece of evidence allowing the Fed to proceed with confidence.

Impact on Rate Cuts: The probability of a 25-bps rate cut at the FOMC meeting this week (Dec 9–10) remains highly elevated, currently priced at 87%–90%.

Fed December Meeting

Despite the clarity provided by the PCE data, the labor market remains the primary source of policy uncertainty ahead of the FOMC meeting. Mixed signals from last week complicate the Fed’s messaging, even if a rate cut is delivered this week. The divergence means the Fed’s ultimate decision will be shaped by how it weighs these conflicting employment indicators.

While the market is currently pricing in a December cut, attention remains sharply focused on the Fed’s pivot for 2026, particularly through the Summary of Economic Projections (SEP).

US Dollar Outlook: Consolidation at the Crossroads

The U.S. Dollar sits at a critical inflection point, consolidating tightly ahead of the FOMC decision. The immediate risk leans to the downside, though any decline is expected to be orderly unless the Fed delivers an aggressively dovish message.

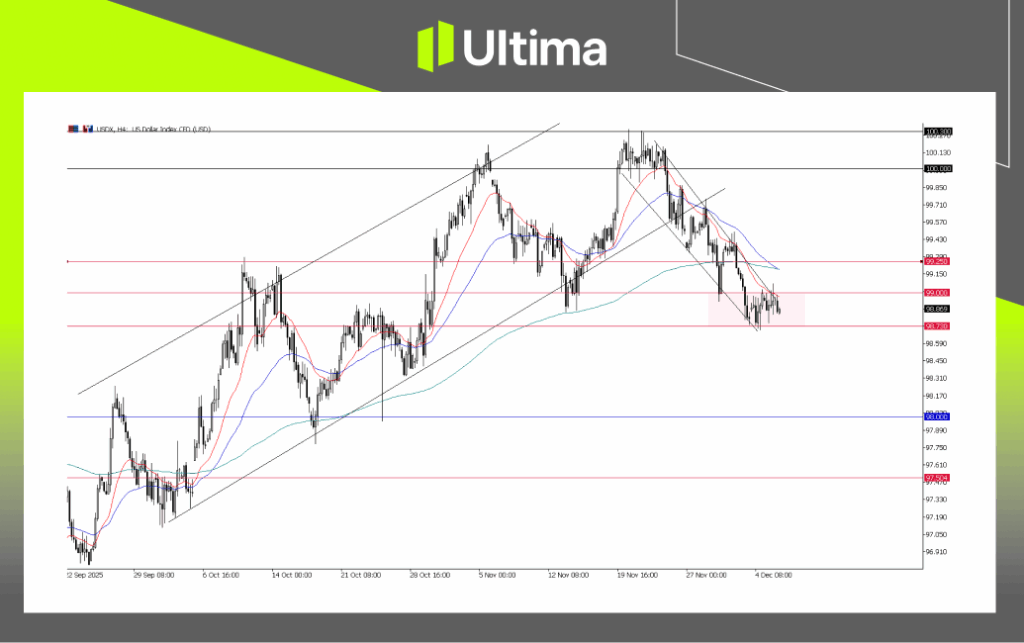

The USDX is hovering just below the 99.00 level, maintaining a tight trading range that preserves the broader bearish bias. Markets are consolidating as traders await the FOMC statement on Wednesday.

USDX, H4 Chart | Ultima Markets MT5

The U.S. Dollar is positioned within a key bearish zone, suggesting mounting downside pressure. Failure to reclaim the 99.00 level would keep the broad downside intact.

A dovish cut—especially if Chair Powell signals that this is the first of several reductions due to weak labor data—would likely drive the Dollar lower. Conversely, a cautious or neutral stance could stabilize or even lift the Dollar temporarily.

Central Bank Super Week: Policy Outlook

This week is shaping up as a pivotal “Central Bank Super Week,” with several major banks announcing policy decisions. Divergent policy directions are expected to create significant movements across U.S. Dollar pairs.

While the Fed is preparing for a rate cut, other central banks are likely to signal a pause in easing or a cautious pivot, presenting a potential structural divergence that could favor their respective currencies against the U.S. Dollar.

- Reserve Bank of Australia (RBA – Dec 9): Expected to HOLD Unlike the Fed, the RBA faces sticky domestic inflation and a tight labor market. Markets are pricing in a pause, keeping the cash rate at 3.60%, with a likely hawkish tone. This divergence—Fed cutting while RBA holds—is structurally bullish for AUD/USD.

- Bank of Canada (BoC – Dec 10): Expected to PAUSE/HOLD Following recent aggressive easing, strong Canadian employment data last week have shifted market expectations toward a pause, allowing the BoC to assess the impact of prior cuts. The removal of immediate dovish pressure supports the Canadian Dollar.

- Swiss National Bank (SNB – Dec 11): Expected to HOLD With inflation stabilizing near 0% and the Franc already strong, the SNB is expected to maintain its policy rate at 0%, preserving flexibility for potential future shocks.

Daily Market Takeaway

Monday is expected to be a relatively quiet session as markets remain on hold ahead of this week’s key events. From Tuesday onward, however, volatility is likely to pick up.

The broader market theme for the week remains “Sell the Dollar on Divergence,” reflecting the growing policy gap: the Fed appears set to pivot toward a rate cut, while other major central banks are likely to hold or pause their easing cycles.

Beyond the Fed’s imminent decision, markets will closely watch how the U.S. central bank frames its monetary policy path into 2026, alongside projections from other major central banks, as these divergences will continue to drive currency and risk-asset flows.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server