Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomDollar Under Pressure, Equities Capped as Trade War Risks Intensify

Daily Market Insights – October 15, 2025, brought to you by Ultima Markets

U.S.–China Trade Outlooks Remain Fragile

U.S.–China trade relations remain at the center of the global macro narrative as tensions continue to intensify. The latest Trump’s statements are also adding significant fuel to the fire.

- In a recent meeting with Argentina’s President Milei, Trump emphasized that the U.S. “must be careful with China”, acknowledging that while the relationship is “fair,” it is also tested frequently.

- Beyond broad tariffs, he also floated targeting “cutting the trade ties with China in cooking oil” as a retaliatory measure for Beijing’s reduction in purchasing US soybeans.

- He has also indicated that China must “pay a Price” for its tightening control on rare earth exports and has floated the possibility of 100% tariffs on Chinese good.

Ultima Market analysts suggest this is more symbolic than materially impactful given the small scale of this segment. Still, this message from Trump reinforces a hardline stance and escalate tensions further, even as U.S. officials publicly maintain negotiations are possible.

Markets are now forced to digest the greater risk of tangible retaliation or broader trade escalation and the Uncertainty ahead of Trump–Xi engagement at the APEC summit, which could determine whether escalation can be moderated.

US Equities: Trade tensions Capping Sentiment

U.S. equities remain range-bound, balancing optimism over Fed easing and corporate earnings against lingering U.S.–China trade risks.

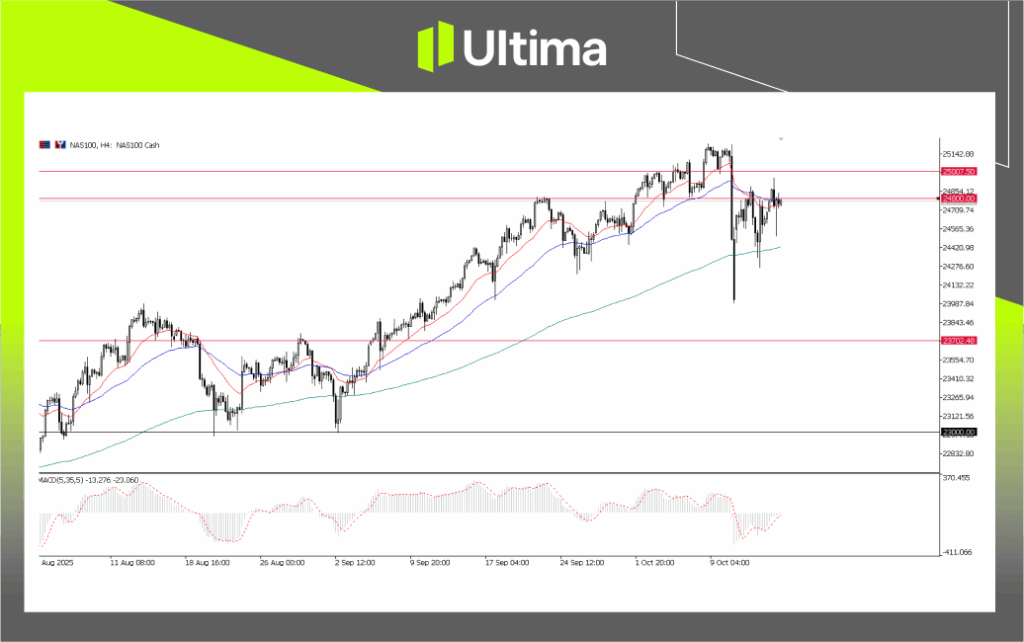

NAS100, H4 Chart | Source: Ultima Market MT5

The Nasdaq 100 has rebounded in recent sessions, supported by President Trump’s more measured comments earlier this week and stronger-than-expected tech earnings. This has provided short-term relief to broader market sentiment.

However, underlying trade risks remain a key overhang. From a technical perspective, the 24,800–25,000 zone represents a critical resistance area—the same level that triggered a sell-off last week. A sustained failure to break above this zone could leave the index vulnerable to renewed downside pressure if trade tensions intensify.

At this stage, trade remains the dominant macro risk weighing on sentiment, and any escalation could quickly shift the market back into a risk-off posture.

Fed Dovish Pressure US Dollar

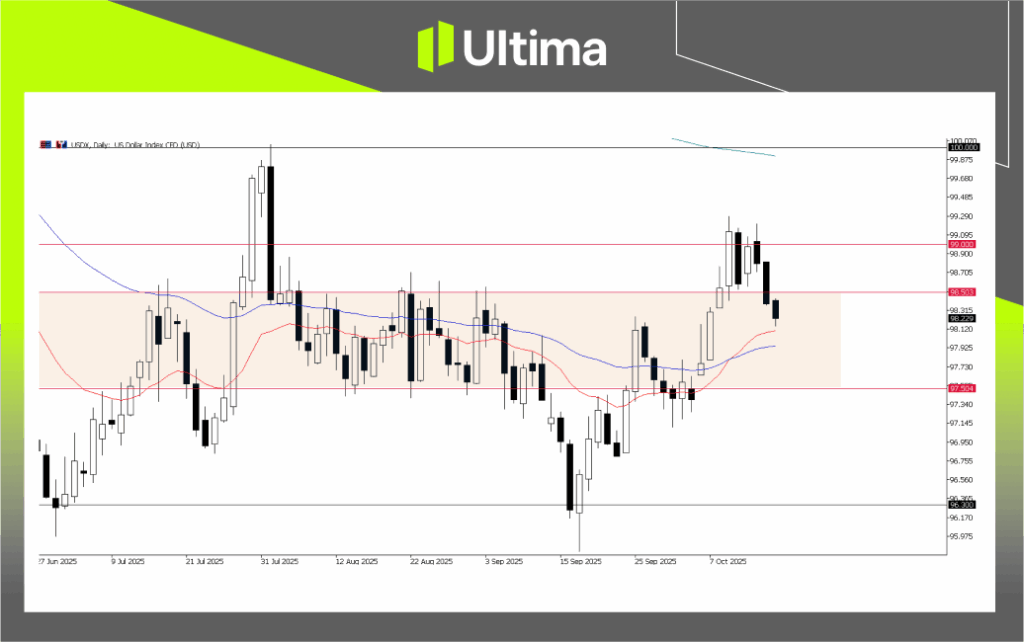

The U.S. dollar weakened further on Wednesday, with the U.S. Dollar Index breaking below the key 98.50 support level.

Comments from Fed Chair Jerome Powell earlier this week continue to weigh on the greenback. Powell highlighted that a sharp slowdown in hiring and rising downside risks to employment have shifted the Fed’s policy stance toward a more accommodative path.

- Markets are now pricing in two additional rate cuts by year-end.

- The ongoing U.S. government shutdown continues to delay key economic data such as CPI, adding uncertainty to the Fed’s data-dependent approach.

- Traders remain sensitive to any Fed communications or leaks ahead of the next FOMC meeting.

USDX, Daily Chart | Source: Ultima Market MT5

Technically, the break below 98.50 is a bearish signal, suggesting the greenback may be entering a deeper corrective phase—especially in the current environment of rising Fed easing expectations and trade uncertainty.

Unless the dollar can reclaim this support level, further downside momentum may build in the near term.

EUR/USD: Caught Between USD Flows and Growth Concerns

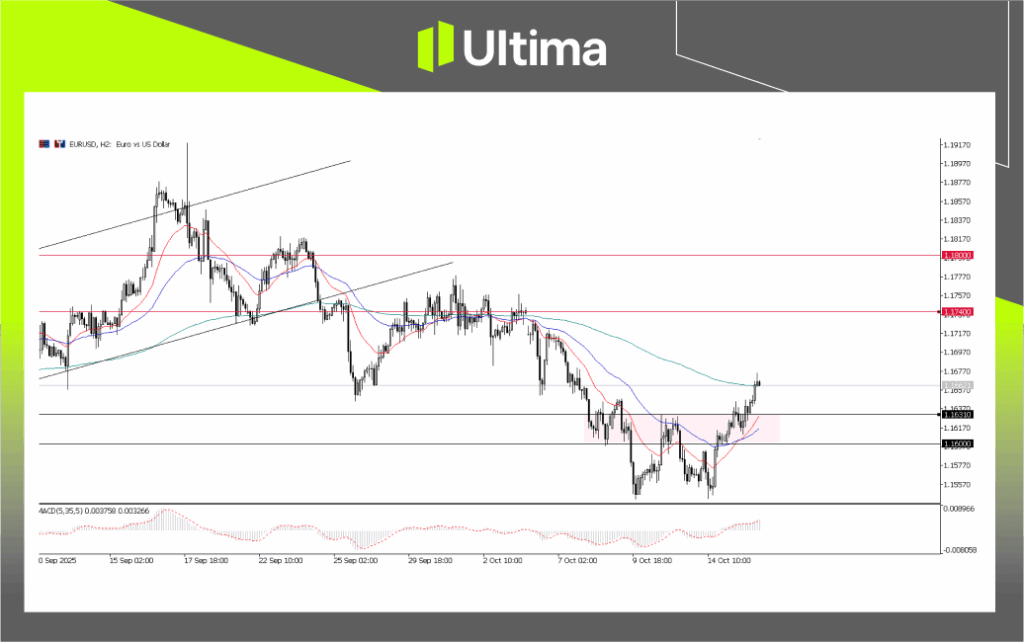

The euro remains under pressure as weak Eurozone economic data and political instability in France continue to weigh on market sentiment. At the same time, EUR/USD movement is largely dictated by U.S. dollar dynamics, particularly in the context of Fed easing expectations and trade developments.

EUR/USD, H2 Chart | Source: Ultima Market MT5

From a technical perspective, EUR/USD has rebounded above the 1.1600 key support after briefly attempting to break lower earlier in the session.

Price action shows a short-term double bottom pattern, signaling the potential for a bullish reversal if the 1.1600–1.1630 zone holds firm.

A sustained move above this support zone could set the stage for further upside in the coming sessions, particularly if the U.S. dollar remains under pressure from dovish Fed expectations and macro uncertainty.

Market Takeaway

- Trade risks and export control headlines remain the primary driver of global market sentiment.

- A dovish Fed tone continues to anchor yields, supporting gold and risk assets.

- The U.S. dollar remains vulnerable as easing expectations deepen. EUR/USD is trading heavy, but a weaker dollar leaves room for upside potential if key support levels hold.

- Traders should stay nimble and monitor diplomatic developments closely ahead of the November 1 tariff deadline, as headline risks could trigger swift sentiment shifts across asset classes.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server