Ultima Markets App

Trade Anytime, Anywhere

Important Information

This website is managed by Ultima Markets’ international entities, and it’s important to emphasise that they are not subject to regulation by the FCA in the UK. Therefore, you must understand that you will not have the FCA’s protection when investing through this website – for example:

- You will not be guaranteed Negative Balance Protection

- You will not be protected by FCA’s leverage restrictions

- You will not have the right to settle disputes via the Financial Ombudsman Service (FOS)

- You will not be protected by Financial Services Compensation Scheme (FSCS)

- Any monies deposited will not be afforded the protection required under the FCA Client Assets Sourcebook. The level of protection for your funds will be determined by the regulations of the relevant local regulator.

Note: Ultima Markets is currently developing a dedicated website for UK clients and expects to onboard UK clients under FCA regulations in 2026.

If you would like to proceed and visit this website, you acknowledge and confirm the following:

- 1.The website is owned by Ultima Markets’ international entities and not by Ultima Markets UK Ltd, which is regulated by the FCA.

- 2.Ultima Markets Limited, or any of the Ultima Markets international entities, are neither based in the UK nor licensed by the FCA.

- 3.You are accessing the website at your own initiative and have not been solicited by Ultima Markets Limited in any way.

- 4.Investing through this website does not grant you the protections provided by the FCA.

- 5.Should you choose to invest through this website or with any of the international Ultima Markets entities, you will be subject to the rules and regulations of the relevant international regulatory authorities, not the FCA.

Ultima Markets wants to make it clear that we are duly licensed and authorised to offer the services and financial derivative products listed on our website. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation.

By confirming your decision to proceed with entering the website, you hereby affirm that this decision was solely initiated by you, and no solicitation has been made by any Ultima Markets entity.

I confirm my intention to proceed and enter this website Please direct me to the website operated by Ultima Markets , regulated by the FCA in the United KingdomU.S.–China Trade Tensions Lift Gold, Weigh on Oil

Daily Market Insights – October 14, 2025, Brought to you by Ultima Markets

U.S.–China Trade Tensions Escalate but Diplomatic Signals Emerge

Global markets are navigating another volatile session as U.S.–China trade tensions intensify, though diplomatic backchannels offer a glimmer of relief.

Both sides have now rolled out reciprocal port fees on maritime shipping — with Beijing targeting U.S.-flagged vessels — marking the first tangible retaliatory measure since Washington’s announcement of 100% tariffs on Chinese imports starting November 1.

At the same time, officials have stressed that diplomatic engagement remains ongoing. U.S. Treasury Secretary Scott Bessent confirmed that the Trump–Xi meeting in South Korea will proceed as planned, suggesting that tariffs may be negotiable if talks make progress.

These mixed signals have left markets cautious. Safe-haven assets remain well supported, while risk assets are showing signs of stabilization after last week’s sell-off.

Gold: Surpasses $4,100 with Another Record Rally

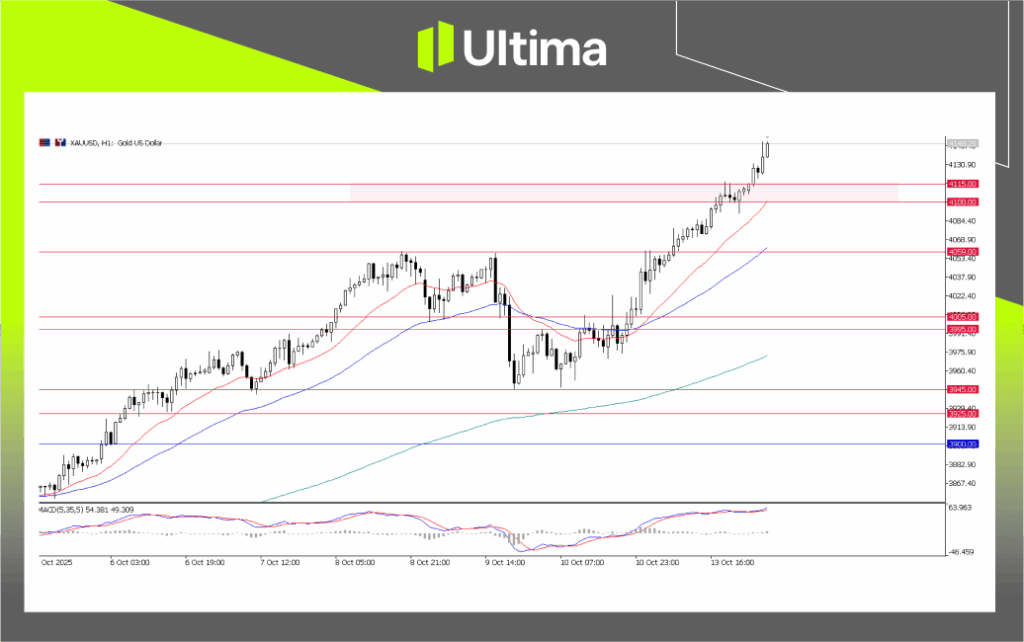

Gold continued its powerful rally above $4,000, breaking through the $4,100 mark on Monday and extending its record-setting momentum in early Tuesday trade. As of this writing, gold is trading near $4,150, reflecting persistent safe-haven demand.

Last week’s brief rejection from the previous record high of $4,059 triggered a pullback, but buyers quickly regained control around the $4,000–$3,995 support zone, fueling renewed upside momentum.

XAU/USD, H1 Chart | Source: Ultima Market MT5

- With gold now holding above $4,100, this level becomes the key short-term pivot sustaining the uptrend structure.

- A decisive rally through $4,150 could open the door toward $4,200 and beyond.

- The U.S.–China trade uncertainty is expected to keep the safe-haven premium elevated, supporting gold until there’s a clear shift in market sentiment.

Oil: Risk Premium Eases, Fundamentals Still Soft

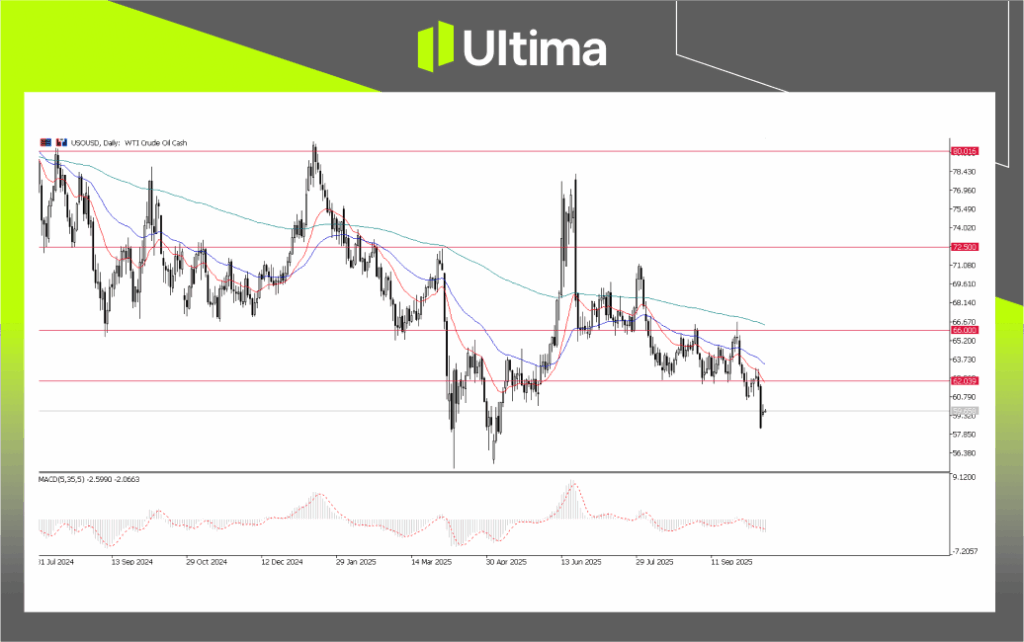

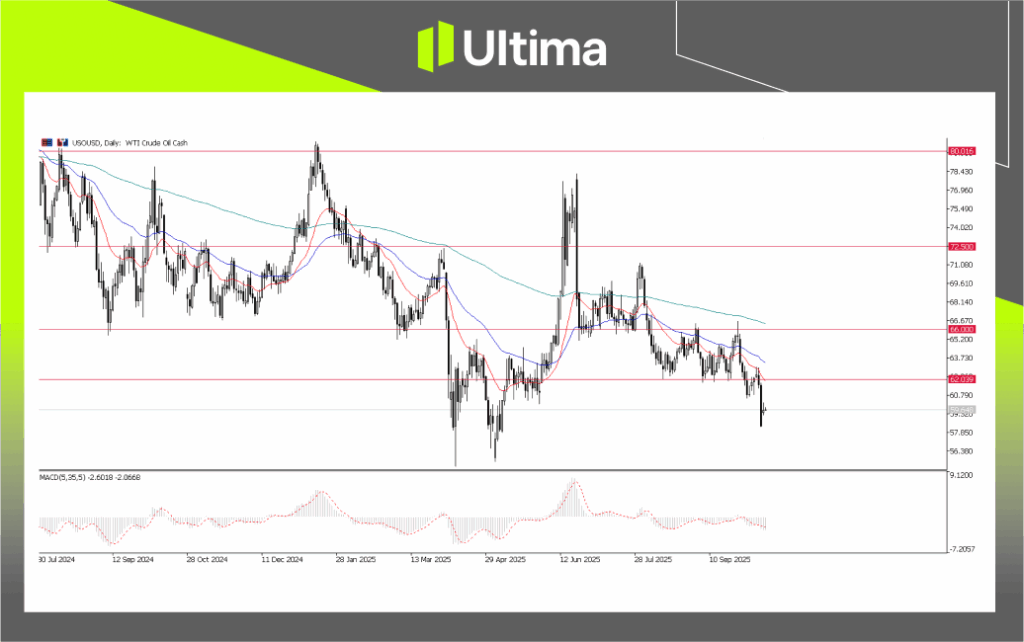

Oil prices are stabilizing as the Gaza ceasefire continues to ease short-term risk premiums. Meanwhile, traders are closely monitoring the U.S.–China tariff developments, which could have meaningful implications for global demand sentiment.

On the demand side, the reciprocal port fees imposed by the U.S. and China have added a negative tone to oil markets, with traders anticipating slower trade flows if tensions escalate further.

On the supply side, OPEC’s latest report indicates a smaller supply deficit for 2026, citing steady production increases. This outlook keeps overall sentiment cautious, despite occasional short-lived rebounds in prices.

USOUSD, Daily Chart | Source: Ultima Market MT5

UKOUSD, Daily Chart | Source: Ultima Market MT5

Technically, both WTI and Brent crude are struggling to break through key resistance levels:

- Brent: $66.00

- WTI: $62.00

Failure to clear these resistance levels could keep oil under pressure in the near term, especially if U.S.–China trade relations deteriorate further. While renewed geopolitical flare-ups could trigger temporary upside spikes, these are unlikely to change the broader soft fundamental outlook for oil.

Market Outlook

With tariff uncertainty, the U.S. government shutdown, and persistent geopolitical risks, overall market sentiment remains fragile.

- Safe-haven assets such as gold and silver continue to benefit from heightened uncertainty and risk aversion.

- Oil remains range-bound, with fundamentals outweighing short-term geopolitical spikes.

- Traders will be closely watching any developments from Trump–Xi communications and progress in trade negotiations in the lead-up to the November tariff deadline.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server